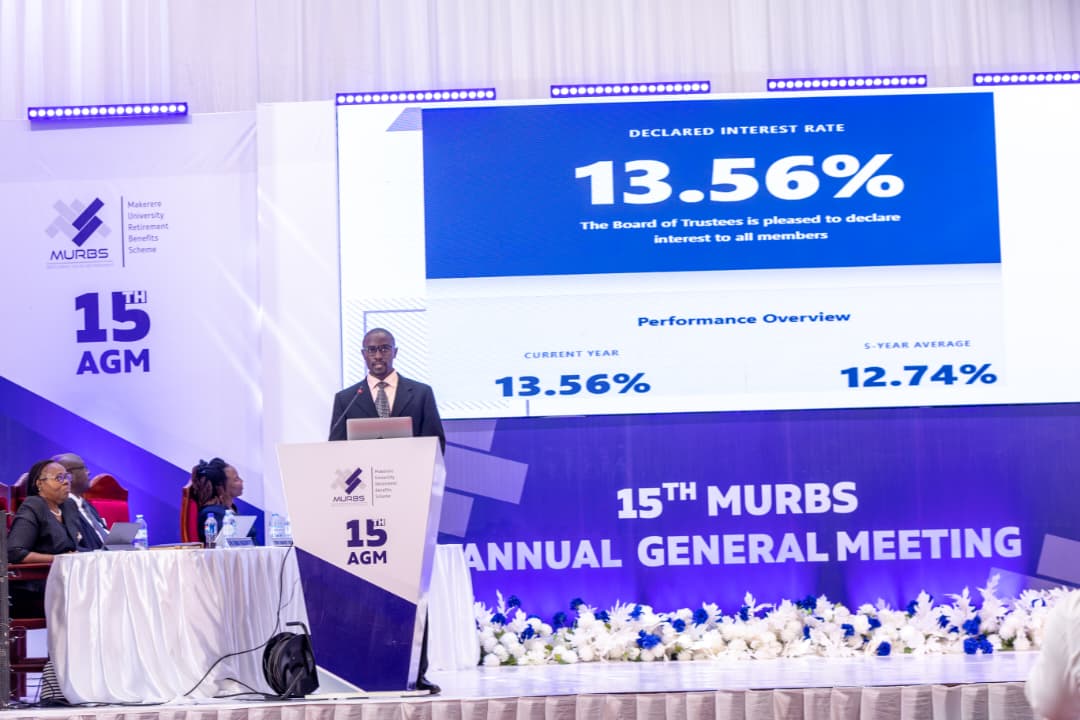

Makerere University Retirement Benefits Scheme (MURBS) has declared an interest rate of 13.56% on members’ balances for the Financial Year ended 30 June 2025, marking another year of strong performance and value creation. The announcement was made during the 15th Annual General Meeting (AGM) held on 23 October 2025 in the Makerere University Main Hall.

According to the Chairperson, Board of Trustees, Dr. Michael Kizito, the Scheme’s performance demonstrates resilience, prudent stewardship, and the continued trust of its members and stakeholders. “The 13.56% interest declared reflects our strong investment performance, efficient governance, and commitment to protecting and growing members’ savings,” Dr. Kizito noted.

The Scheme’s total Fund Value grew by 16.2%, rising from UGX 409.2 billion in June 2024 to UGX 475.5 billion as at 30 June 2025. This growth was supported by consistent remittances from the Sponsor, Makerere University, which increased by 6.4% to UGX 36.6 billion, and prudent investment strategies that focused 86.4% of the portfolio in long-term Government Bonds.

These strategic allocations, approved under a URBRA waiver, ensured sustainable returns and capital safety amidst fluctuating market conditions. Investments in Unit Trusts, Real Estate, and other instruments complemented the portfolio diversification, contributing to a net income of UGX 53.5 billion, which formed the basis for the interest distribution to members.

Material Matters, Risk and Resilience

The Chairperson emphasized that the Scheme’s achievements are anchored in its Integrated Risk Management Framework, which proactively identifies and mitigates exposure across investment, governance, operational, and financial categories.

The top risks for FY 2024/25 included interest rate volatility, concentration risk, and credit risk—all of which were effectively managed through continuous monitoring and strategic rebalancing.

MURBS’s risk-based decision-making continues to ensure sustainability and protection of members’ benefits, consistent with our fiduciary duty and compliance with URBRA guidelines, Dr. Kizito affirmed.

During the year, the Scheme achieved significant operational milestones, including completion of benchmarking for a new Management Information System (MIS) to enhance data-driven efficiency; development of the MURBS Mobile App, designed to provide members with instant access to benefit calculators and statements. MURBS initiated major steps to procure a Document Management System for efficient records management, and the acquisition of new office premises to accommodate growth and improve member service delivery.

These initiatives are aligned with the Scheme’s five-year Strategic Plan (FY 2023/24 – 2027/28) and its commitment to innovation, transparency, and digital transformation.

Membership and Benefits

Membership rose to 8,515 (3,368 active and 5,147 deferred), while benefits paid totaled UGX 21.7 billion. The Scheme maintained an average benefits processing time of seven (7) days, underscoring its operational efficiency.

MURBS remains focused on timely and accurate benefit disbursements, reflecting our dedication to member satisfaction and financial dignity in retirement, Dr. Kizito reiterated.

The Chairperson, Audit Committee, CPA David Ssenoga, shared comprehensive details on the financial statements for the financial year 2024/25. The auditor, CPA Assad from KPMG, confirmed the accuracy of the financial statements, which included investments in government securities and other assets totaling $480 million. The trustees were praised for their dedication and strategic initiatives, with plans to optimize operations and enhance revenue streams through alternative investments. The conversation ended with the acceptance of the annual report and financial statements by members.

Speaking on behalf of URBRA, Mr. Mark Lotukei commended MURBS Trustees on leveraging sector rules to ensure that members receive the best return on investment for their benefits. “From this year’s presentation, your funds were invested more than 80% in government securities, which shows that your trustees were proactive enough to take advantage of shifts in the marketplace” he commended.

Mr. Lotukei urged MURBS members to use the platform provided by the AGM to not only question the Trustees decisions but also improve their own awareness of how scheme business is conducted. He equally encouraged members to make the most of the regular free online trainings provided by URBRA. “Those two hours could change a lot in terms of enabling you to plan better for your retirement”.

Looking ahead, MURBS is positioning itself to sustain growth through alternative investments, enhanced governance, and robust digital systems. The Chairperson reaffirmed the Board’s commitment to continuous learning, stakeholder engagement, and strategic foresight, ensuring the Scheme remains a model of “Lasting Stewardship – Enduring Value and Resilience.”

The report also outlined MURBS’s future priorities, which include: strengthening the partnership between the Board and the Secretariat; expanding capacity through targeted Trustee and staff training; integrating Environmental, Social, and Governance (ESG) considerations into investment decisions; and delivering enhanced value to members through innovation, digitisation, and responsible leadership.

For 15 years, MURBS has consistently demonstrated excellence in governance, financial reporting, and member service. The Scheme remains the benchmark for transparency and accountability, having won multiple ICPAU Financial Reporting (FiRe) Awards, including the 2024 Best Integrated Report in the Retirement Benefits Sector.

Dr. Kizito concluded, “We remain steadfast in our promise to safeguard members’ savings, optimize investment outcomes, and deliver sustainable value. Our future is one of enduring stewardship, resilience, and shared prosperity.”

📘 Access the Full Report in the link below:

MURBS Integrated Annual Report and Financial Statements for the Financial Year Ended 30 June 2025.